Do you need help with tax calculations and employee payments? If yes, this article is for you! We’re introducing the Best Free Payroll Software for Small Businesses.

Just think that you’re the owner or CEO of your company, and you don’t have a separate department for payments and taxes. Then you have to control this with your existing work, right? We don’t need to tell you how much of a headache process this is!

Here’s the roleplay of payroll software: it helps to decrease the stress in payment calculations and taxes of small businesses.

In this article, we will see what payroll software is and the best 10 free payroll software programs with key features and plans. We’re also comparing the effectiveness of the software. It helps you understand payroll software.

So, without any delay, Let’s get started!!

What is Payroll Software?

In very simple terms, Payroll software is cloud-based software that helps organisations manage their employees’ payments and payroll processes. It helps small businesses or organisations save time, calculate taxes, track expenses, monitor employee hours, etc.

The best payroll software can easily integrate with existing company processes, so choosing the best software according to our requirements is essential!

To help you in the process of selecting the best software, we listed the top best 10 free payroll software below with its features and plans, Evaluate it as per your needs and choose the best fit for you.

Top 10 Free Best Payroll Software for Small Business

Now we know what payroll software means, but choosing the best software according to your needs and its wide availability can overwhelm you!

No need to worry!

We’re here to help. Check out the top 10 free payroll software listed below and choose the best option.

Let’s dive deeper into it!

1. Payroll4free

Payroll4free is one of the best free payroll software programs. It helps small businesses with payroll processing. It includes basic payroll services, such as paying employees and calculating taxes. You can also generate tax forms and create detailed payroll reports with this. It is specially targeted for small businesses that have 10 or fewer employees.

Payroll4free is entirely free of cost; it provides basic services for small businesses in forever free mode with full features.

Features of payroll4free can be listed as follows:

Key Features

Pricing

Payroll4free is free forever for basic modes; there are also paid plans. Users can contact them directly through their official website to learn more.

2. HR.my

HR.my is multilingual, free payroll software. It offers expense claims, leave management, time clocks, attendance tracking, and document workflow. It targets small—to medium-sized businesses looking for cost-effective, feature-rich HR solutions. It also helps with team collaboration and document sharing.

HR.my payroll software is forever free for all basic mode users. It also does not charge any onboard costs and offers a wide range of features.

Let’s delve into its significant features:

Key features

Pricing

HR.my payroll software is forever free in basic modes, and users can contact them directly through their website to learn more.

3. TimeTrex

TimeTrex is known to be one of the best free payroll software programs. It provides free attendance and time clock-based payroll services and helps you pay your employees directly based on their hours worked. It mainly targets businesses looking for an all-in-one scheduling, attendance management, and accounting software solution.

TimeTrex is also known as work management software; it includes so many features;

See the features of TimeTrex:

Key features

Pricing

TimeTrex provides a 30-day free trial for new users. For demos and custom users, they can directly contact the sales team.

| $30/month | $50/month | $80/month |

| Professional Edition | Corporate Edition | Enterprise Edition |

| Comprehensive payroll solutions | Detailed job costing | Expense management and tracking |

4. ExcelPayrol

Excel payroll is a cost-free payroll software specially designed for small businesses. It seamlessly integrates with Microsoft Excel and offers more structured tools. It helps with payments, tax calculations, printable tax forms, and PTO management. It mainly targets nonprofits, small companies, and educators looking for free payroll processing software.

However, ExcelPayroll includes more than 30 employees but not more than 50, so it is highly recommended for small businesses.

Let’s see its features;

Key Features

Pricing

ExcelPayroll is a free-of-cost software; users can contact them directly through their website to learn more.

5. Wave

Wave is cloud-based accounting software that helps you manage your bookkeeping, invoicing, and tax-payment processes in one place. It allows you to create and send unlimited bills and invoices. It mainly targets small businesses looking for a reliable service in a cost-effective mode. It provides you with a user-friendly interface that helps to manage everything easily.

Wave payroll software provides you with a complete picture of your business’s health. It provides so many features.

Check its features:

Key Features

Pricing

Wave provides two plans;

- 30-day free trial for new users

- Premium paid plan for $16/month

6. Gusto

Gusto is an online payroll and HR software that mainly targets startups and small businesses. It helps simplify payroll processing, tax management, leave management, attendance management, and other related tasks. It also offers features like charitable giving, financial wellness tools, and a wallet for employee financial management.

Gusto offers a wide range of features at an affordable range of prices; it can be listed as:

Key Features

Pricing

For demo and custom, users can directly contact to the sales team.

| Simple | Plus | Premium |

| $40/month | $60/month | Exclusive pricing |

| Full services | Full services with direct deposit | Full services with HR resources |

7. OnPay

OnPay is small business payroll software that helps with payroll, employment taxes, and basic HR tasks. The software is completely web-based and can even be accessed on mobile phones or tablets. It mainly targets small businesses, especially those who need a payroll system that goes beyond hours. With its user-friendly interface and affordable pricing, OnPay is a great option for small business owners who need a reliable and efficient payroll software solution.

Onpay features can listed as follows:

Key Features

Pricing

Users can get Onpay’s basic plan with just $40/month. For more detailed plans, contact the sales team.

8. Quickbooks Payroll

Quickbooks payroll software is one of the best solutions for small businesses. It offers streamlined payroll management in one platform, tax penalty protection from W-2 automation, paid time off tracking, and free direct deposit. It mainly targets small businesses looking for cost-effective, reliable services.

Check out its features:

Key Features

Pricing

See the table for plans and pricing:

| Simple Start | Essentials | Plus |

| $15/month | $30/month | $45/month |

| Connect 1 sales channel | Connect 3 sales channel | Connect all sales channel |

9. Homebase

Homebase payroll is cloud-based software that streamlines payment processes and tax calculations. It offers payroll automation, time-tracking integration, tax compliance, and more. It is also mobile-friendly; you can even use it on mobiles and tablets. It mainly targets small businesses and startups.

Homebase offers a free trial to explore and learn about its features for new users. It’s features we can list as:

Key Features

Pricing

Users can learn about the Plans and pricing structure of Homebase from below:

| Basic | Essential | Plus |

| $0 | $20/month | $48/month |

| Basic scheduling | Advanced scheduling | Hiring |

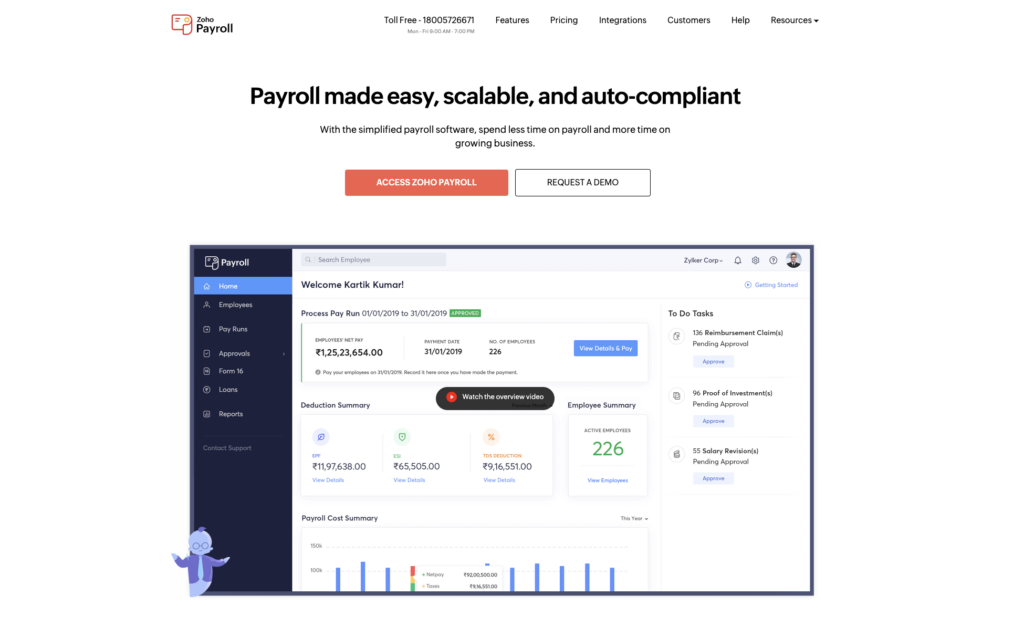

10. Zoho Payroll

Zoho Payroll is one of the best free payroll software. It helps you to manage your payroll online. Also, you can customise your employee pay runs, configure benefits and withholdings, comply with the latest tax regulations, and pay accurate wages every time. It mainly targets small organisations or businesses with employees less than 50.

Zoho payroll is a free forever platform for its basic mode. Also, it provides you with a wide range of features;

Key features

Pricing

| Free | Standard | Professional |

| $0 | $40/month | $60/month |

| All basic features | Minimum employees 25 | Minimum employees 50 |

Comparing the best free payroll software

Take an easy look at the best top 10 payroll software, it helps you to evaluate the difference between each one properly,

Check below:

| Feature | Automated Payroll calculations | Payroll tax filings and direct deposits | Employee self-service portal | Time tracking and attendancemanagement | Comprehensive reporting |

| Payroll4free | x | ✔ | ✔ | ✔ | ✔ |

| HR.my | ✔ | x | ✔ | ✔ | ✔ |

| TimeTrex | ✔ | ✔ | ✔ | ✔ | ✔ |

| Excelpayroll | ✔ | ✔ | x | ✔ | x |

| Wave | ✔ | ✔ | ✔ | x | ✔ |

| Gusto | ✔ | ✔ | ✔ | ✔ | ✔ |

| Onpay | ✔ | ✔ | ✔ | ✔ | ✔ |

| QuickBooks | x | ✔ | ✔ | ✔ | ✔ |

| Homebase | ✔ | ✔ | ✔ | ✔ | ✔ |

| Zoho payroll | ✔ | ✔ | ✔ | ✔ | ✔ |

How do you choose the right free payroll for your small business?

Before choosing the right free payroll for your small business, you need to confirm that it satisfies your requirements; also, you can check if it is the best one for you or not by evaluating it with the below-mentioned factors:

Choosing the best free software for your small business is completely according to your needs and requirements. Evaluate the software properly before choosing a paid plan. Also, if they’re providing free plans, don’t hesitate—just try it and make it clear whether it suits you or not!

Tips for using free payroll software:

While using free payroll software, you need to know about that software properly first and follow the following tips mentioned below:

By following the tips mentioned above, you can make the most of free payroll software.

FAQs

What is the best free Payroll software for small businesses?

Several free payroll software programs for small businesses are available; some of the best are payroll4free, TimeTrex, Wave, etc.

What does free payroll software include?

Free payroll software typically includes all kinds of features that’ll help to enhance the small business without a fee. Such as payroll processing, tax calculations, direct deposit, etc.

Can I use free payroll software for my small business?

Yes, there are many payroll software programs available, especially for small businesses, such as Zohopayroll, payroll4free, Wave, etc.

Is free payroll software secure?

Yes. It is secure, but the security of the software can vary sometimes. However, most software offers good security.

How do I get started with free payroll software?

The first thing you need to consider before starting to use free payroll software is choosing the software that fits your needs and then evaluating its features accordingly.

How do I file payroll taxes with payroll software?

Complete your tax setup, run payroll, review tax calculations, and submit payment.

How do I use my payroll software to pay my employees?

To use payroll software to pay your employees, you just need to set up your account and choose payroll processing; the process can vary from software to software.

What If I have questions about using free payroll software?

If you have questions related to using free payroll software, then you can contact customer support and check out their features as well.

Conclusion

We evaluated the best 10 free payroll software that can help you with your small businesses. We saw its key features and plans, and we also saw tips on choosing the best software.

Now, it’s your turn to assess your needs, evaluate them with the above-mentioned software, and choose the best fit for you.

Don’t take this kind of headache activity yourself; let the technology do it rest!

We hope this article helps you understand payroll software. We would also like to hear your valuable opinions about this article through the comment section.